AI Legal Risk Analysis: Can AI Understand Risk? How Qanooni Handles It

Lawyers are right to be sceptical. Spotting unusual wording is easy; understanding why a clause is risky depends on your client, jurisdiction, and firm standards. Generic AI often flags anomalies without context. Qanooni approaches risk differently combining contract analysis with precedent memory, jurisdictional awareness, and your firm's practise.

Definition: AI legal risk analysis identifies, explains, and prioritises contract terms that may create liability, conflict, or compliance problems in the context of the deal and jurisdiction.

Why Generic AI Struggles with Legal Risk Analysis

Large language models are good at detecting text that looks "different." That isn't the same as risk.

Context changes the answer:

- A liability cap that's fine for a customer can be risky for a supplier.

- A five-year term might be normal in a lease but unusual in SaaS.

- A governing law that works in London can fail in Dubai.

This is why generic contract review AI struggles. Without precedent or jurisdiction awareness, it misses the why behind risk.

Qanooni's AI Legal Risk Analysis Logic (How It Works)

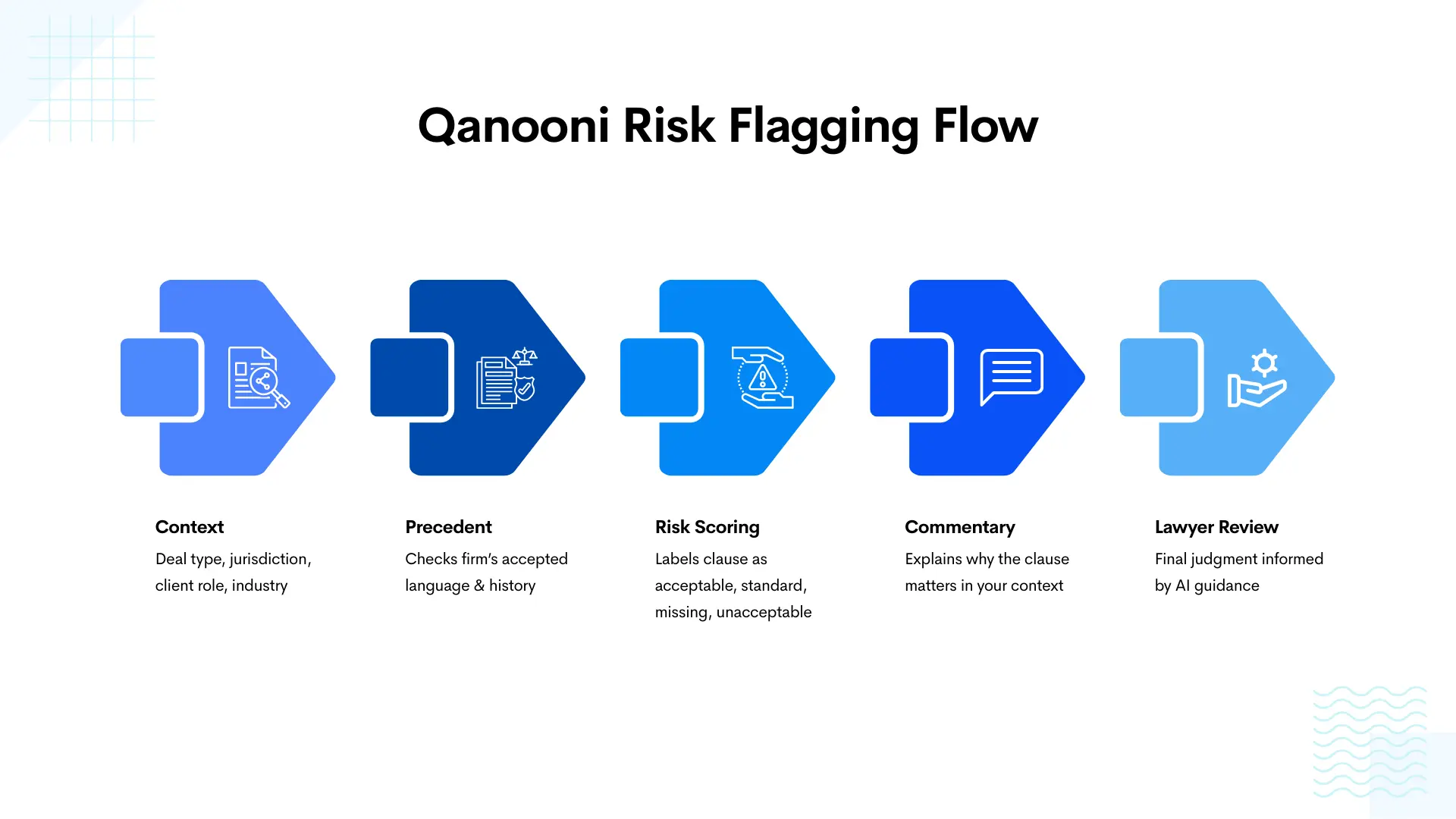

Qanooni reviews each clause against deal context, jurisdiction, and your precedent—then labels it acceptable, non-standard, missing, or unacceptable with clear commentary.

- Contextual matching : considers deal type, client role, governing law, and sector norms.

- Precedent alignment : checks what your firm has accepted in comparable matters.

- Risk scoring : ranks clauses by frequency, acceptance history, and alignment to your standards.

- Explanatory commentary : tells you not just that something is off, but why it's a risk for you.

- Continuous learning : your edits feed Passive Playbooks, so future reviews reflect your evolving bar.

Examples of Qanooni Risk Analysis

Term length: Instead of only flagging "5 years" as unusual, Qanooni explains: "Your typical range is 1–3 years; 5 years exceeds it."

Liability caps: Qanooni highlights whether a cap sits inside your historic range and calls out common carve-outs (fraud, wilful misconduct, IP, confidentiality). The fact that these caps and carve-outs are heavily negotiated is well-documented in in-house guidance.

Missing clauses: In UAE employment contracts, Qanooni identifies if a non-compete clause is absent, referencing precedent usage.

Global and Jurisdiction Specific Adaptation

Risk looks different across jurisdictions and Qanooni adapts accordingly:

UAE (civil law; bilingual realities): Courts prioritise Arabic; English-only contracts often need certified Arabic translations for proceedings. That language layer affects enforceability and introduces risk if terms aren't mirrored correctly. Dubai Legal Affairs Department.

UK (reasonableness controls liability): Limitation clauses must satisfy the UCTA reasonableness test "fair and reasonable…having regard to all the circumstances." Qanooni's analysis reflects that standard when labelling caps and carve-outs.

US (SaaS & consequential damages): It's common to waive consequential damages; the real question is whether the waiver/exceptions match market practise for the deal. ABA Business Law Section notes how these waivers manage exposure.

The takeaway: risk profiles vary by forum and deal type. Qanooni's flags and commentary adapt to local norms rather than applying a generic global template.

Why Contextual Risk Analysis Matters

- Fewer false flags → less time re-litigating harmless anomalies.

- Faster reviews → commentary is tied to your norms, not generic rules.

- Consistent decisions → partners, associates, and offices speak with one risk posture.

See how Qanooni personalises drafting and review for more on how firm standards are applied.

The Qanooni risk flagging process: from contextual analysis through precedent matching, risk scoring, explanatory commentary, and final lawyer review.

FAQs

What is AI legal risk analysis?

AI legal risk analysis is the use of artificial intelligence to identify and explain contract terms that may create liability, conflict, or compliance problems in context.

Can AI really understand legal risk?

Generic AI flags anomalies; Qanooni maps risk to deal type, jurisdiction, and your standards, then explains why it matters.

How does Qanooni flag legal risk?

Qanooni labels clauses acceptable, non-standard, missing, or unacceptable and adds brief, precedent-aware commentary.

Does it adapt to different jurisdictions?

Yes. UAE bilingual issues, UK UCTA reasonableness, US SaaS waivers—all reflected in how Qanooni labels and explains clauses.

Why is AI legal risk analysis important?

Because without context, "flags" are meaningless. Qanooni makes them actionable by grounding them in your practise.

What are the benefits for law firms?

Faster reviews, fewer surprises, and consistent application of firm standards across matters and jurisdictions.

How is Qanooni different from generic AI review?

It doesn't stop at "this looks odd." It tells you if it's off for your firm, in this jurisdiction, and this deal—and it learns from your edits (Passive Playbooks).

Next Steps

AI can highlight unusual clauses. Qanooni explains why they're risky in your context.