The Global Guide to Legal Document Compliance

For much of legal history, compliance obligations were domestic. A London solicitor worried about UK statutes and SRA rules, a New York attorney about state law and federal oversight, and a Dubai lawyer about UAE codes and bilingual contracts. That world no longer exists. Clients now operate globally, transactions cross multiple jurisdictions, and regulators expect compliance across every applicable regime. This has created a new reality: compliance is no longer domestic, it is global. Without the right systems, firms risk drowning in obligations they cannot manually track. Legal compliance automation has emerged as the only sustainable way forward.

What We Mean by Legal Compliance Automation

Legal compliance automation is the application of artificial intelligence to contracts and legal documents so that every clause is checked against the standards that matter whether GDPR in Europe, HIPAA in the United States, the UAE's Data Protection Law, or Singapore's PDPA. Unlike static checklists, compliance automation is dynamic. It explains why a clause fails, adapts as laws change, and learns from a firm's own precedents.

Consider a cross-border outsourcing agreement. A European lawyer may be satisfied once Standard Contractual Clauses are included for GDPR. But in the UAE, those clauses carry no force. The 2020 Data Protection Law requires local equivalents. Without automation that recognises jurisdictional nuance, a firm risks telling its client they are compliant when they are not.

The Challenge of Multi-Jurisdiction Risk

Multi-jurisdiction compliance is not about more rules, it is about conflicting rules. A clause that clears Brussels may fail in Abu Dhabi. A privacy provision acceptable under California's CCPA may breach Singapore's PDPA. The lawyer's task is not just to spot the clause, but to know which regulator has authority and how that regulator interprets compliance.

Healthcare illustrates the challenge. A US hospital's IT contract must comply with HIPAA, which demands strict business associate agreements. If the hospital also serves EU patients, GDPR requirements apply. If the IT vendor is in Dubai, UAE law adds bilingual enforceability obligations. Reconciling these rules manually can take days. A generic AI tool might flag anomalies but will not understand which obligations actually matter. Context-aware compliance automation shortens that reconciliation to minutes.

Global Compliance in Practice

Europe: GDPR requires more than a privacy policy. Firms must show accountability, data minimisation, and lawful transfer mechanisms. Cross-border clauses must align with SCCs or Binding Corporate Rules.

United Kingdom: UK GDPR continues post-Brexit, with SRA Codes of Conduct and Lexcel standards layering on additional governance requirements such as client care obligations.

Middle East: The UAE's Data Protection Law 2020 is enforced alongside DIFC and ADGM frameworks. Contracts must often exist in Arabic and English, with mismatches threatening enforceability. Arbitration agreements that omit Arabic provisions can collapse under scrutiny.

United States: HIPAA governs healthcare privacy, SOX regulates corporate governance, and CCPA drives consumer protection. Each law operates differently, forcing firms to map obligations state by state.

Asia-Pacific: Singapore's PDPA stresses consent and retention, India's DPDP Act of 2023 modernises personal data rights, and China's PIPL requires localisation and state review. Hong Kong's PDPO and Australia's Privacy Act add further regional obligations. Cross-border technology deals must address them all.

How AI Strengthens Compliance Automation

AI supports lawyers not by replacing judgement but by accelerating it. A robust system:

- Classifies clauses as acceptable, non-standard, missing, or unacceptable.

- Provides commentary that explains why the clause fails under GDPR, HIPAA, or UAE law.

- Learns from firm precedents so that every partner's redlines inform future reviews.

- Updates as laws change, reflecting new statutes and regulations in real time.

Generic AI fails because it cannot apply context. It might flag a five-year retention period as unusual without knowing that under Singapore's PDPA, retention must be linked to purpose. It may ignore the absence of Arabic translation that makes a UAE employment contract unenforceable. Qanooni's approach ensures that commentary is anchored to jurisdiction, precedent, and practice, giving lawyers the reasoning they expect to see.

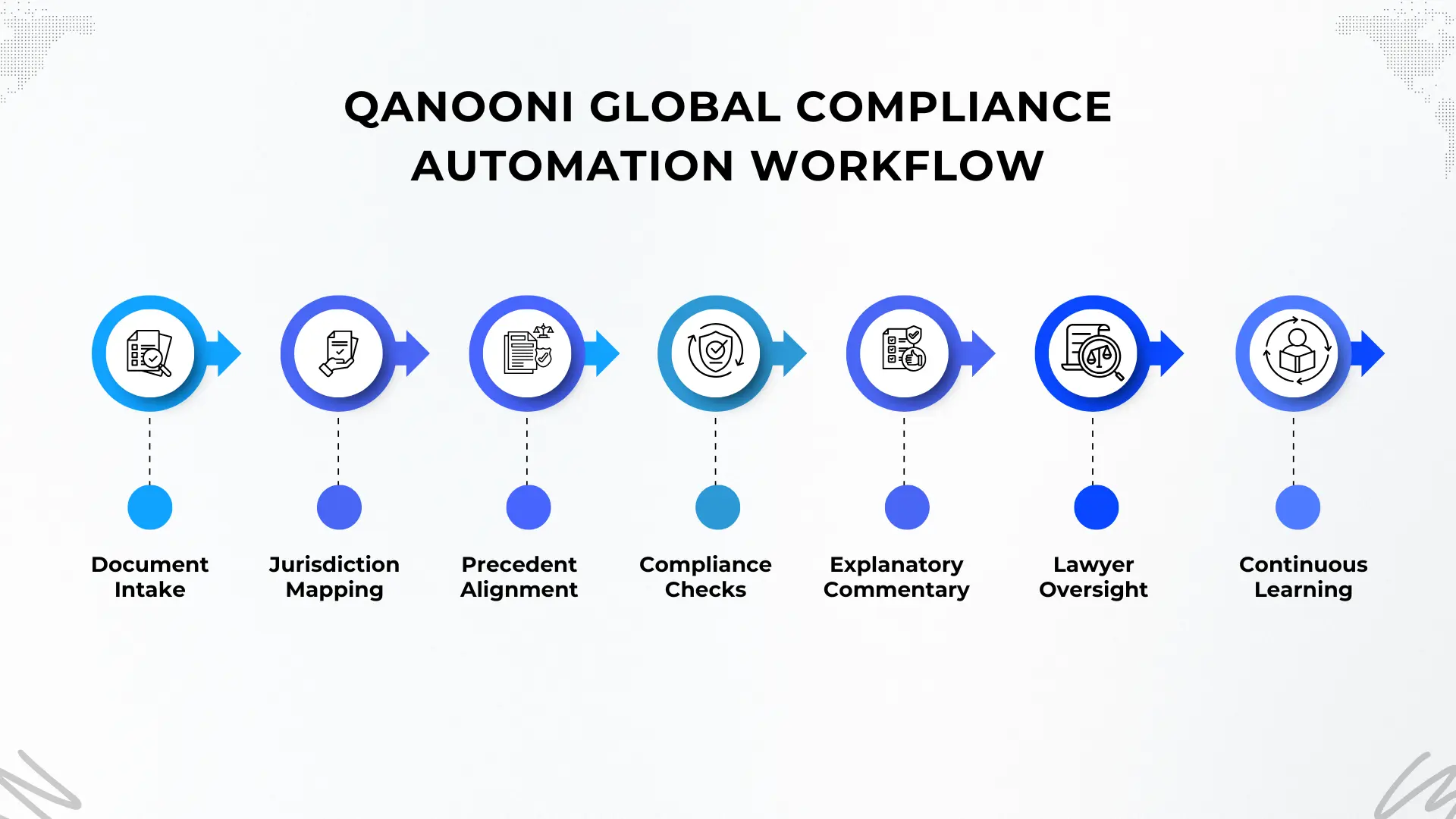

Visual Framework: Global Compliance Automation Workflow

Case Examples

- A UK firm reviewing outsourcing agreements found that Qanooni flagged missing client consent language required under Lexcel, preventing a regulatory audit issue.

- In Dubai, Qanooni highlighted mismatched Arabic and English clauses in an employment contract, ensuring compliance with UAE bilingual requirements.

- A US healthcare provider used Qanooni to confirm HIPAA business associate clauses were not diluted by vendor templates, avoiding downstream liability.

- A Singapore based data transfer agreement was mapped to PDPA consent requirements, preventing breach of local law.

- In Hong Kong, Qanooni flagged data retention periods inconsistent with the PDPO's requirements, giving the firm time to adjust before filing.

These cases demonstrate that compliance automation only works when tuned to jurisdiction and sector. A single missed clause in one market can derail the whole deal.

Why Context Matters Most

Compliance without context is a dangerous illusion. A checklist that flags anomalies without understanding regulatory nuance creates false confidence. Context-aware automation reduces false positives, speeds reviews, and ensures that firms uphold both local law and internal precedent. The difference is not academic;it is existential. Clients want assurance that their contracts will survive scrutiny in every relevant court or regulator's office. Lawyers need systems that allow them to deliver that assurance.

Qanooni was built to provide that assurance. By weaving jurisdiction-specific obligations with firm precedents, it scales compliance globally without sacrificing local detail. The lawyer remains in control; AI accelerates the work.

See how Qanooni automates compliance across borders → Book a Demo

FAQs

What is legal compliance automation?

Legal compliance automation uses AI to check contracts against relevant frameworks such as GDPR, HIPAA, UAE DP Law, and PDPA while explaining risks in context of jurisdiction and precedent. Unlike static checklists, it adapts as laws evolve.

How does AI help with multi-jurisdiction compliance?

AI maps documents against multiple regimes at once, identifying where a clause may pass GDPR but fail UAE DP Law, or where a HIPAA clause does not satisfy EU standards. It reduces oversight risk by highlighting conflicts and explaining why they matter.

Can AI replace lawyers in compliance review?

No. Regulators like the SRA and ABA emphasise human oversight. AI accelerates compliance checks and provides reasoning, but lawyers make final judgements on client strategy and risk acceptance.

What are the risks of relying on generic compliance AI?

Generic tools miss jurisdiction-specific requirements. They may generate false positives, slowing reviews, or worse, miss obligations altogether, exposing clients to fines and disputes.

Which laws can compliance automation cover globally?

Qanooni adapts to GDPR, UK GDPR, SRA, UAE DP Law, HIPAA, SOX, CCPA, Singapore PDPA, India DPDP Act, China's PIPL, Hong Kong's PDPO, and Australia's Privacy Act, with continuous updates as new regulations emerge.

Closing Thought

Compliance is not optional; it is existential. Firms that rely on static checklists or generic AI expose clients to regulatory penalties and reputational damage. Context-aware automation is the only sustainable way to manage cross-border risk. Qanooni ensures contracts align with every relevant jurisdiction while preserving the firm's own precedents. Lawyers remain in control. AI does the heavy lifting. That is how global compliance becomes a competitive advantage rather than a liability.